Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026

Related Articles: Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026

- 2 Introduction

- 3 Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026

- 3.1 Unveiling the Structure: A Break from Tradition

- 3.2 Advantages of the 4-4-5 Fiscal Calendar: A Closer Look

- 3.3 Implementing the 4-4-5 Fiscal Calendar: A Practical Approach

- 3.4 FAQs: Addressing Common Concerns

- 3.5 Tips for Successful Implementation:

- 3.6 Conclusion: A Promising Future for Financial Management

- 4 Closure

Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026

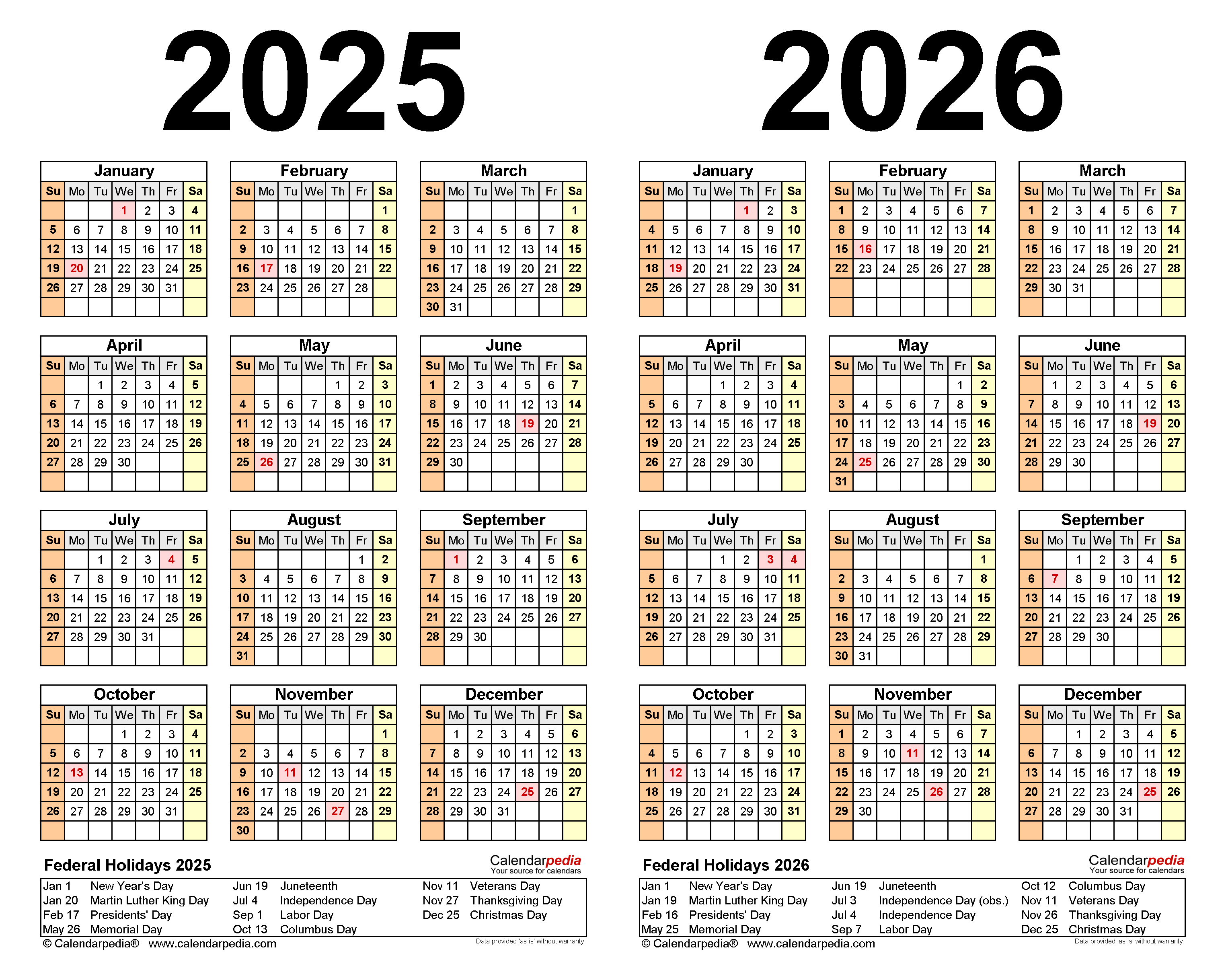

The world of finance and accounting operates on a complex system of calendars and cycles. One such system, gaining increasing traction, is the 4-4-5 fiscal calendar. This calendar structure offers a unique approach to financial planning and reporting, potentially providing significant benefits for businesses and organizations. This article aims to demystify the 4-4-5 fiscal calendar, exploring its structure, advantages, and potential applications for 2026.

Unveiling the Structure: A Break from Tradition

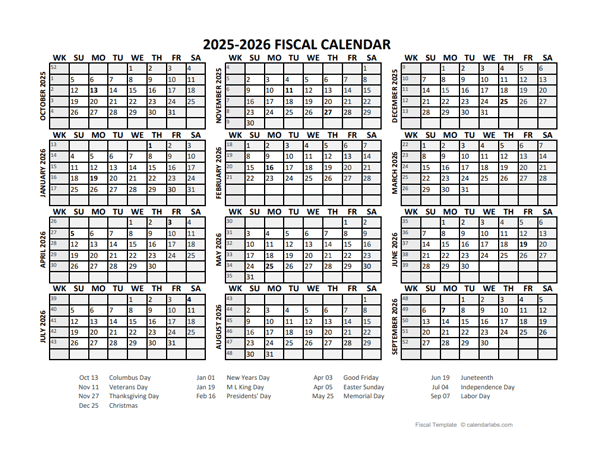

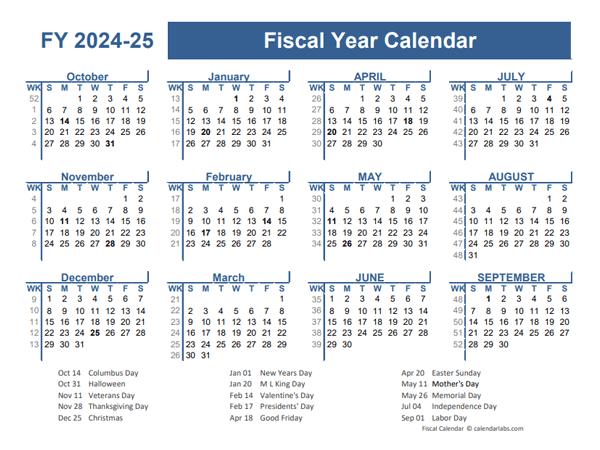

The traditional fiscal calendar, often aligned with the Gregorian calendar, operates on a 12-month cycle. The 4-4-5 fiscal calendar, however, introduces a distinct variation. It divides the year into three periods:

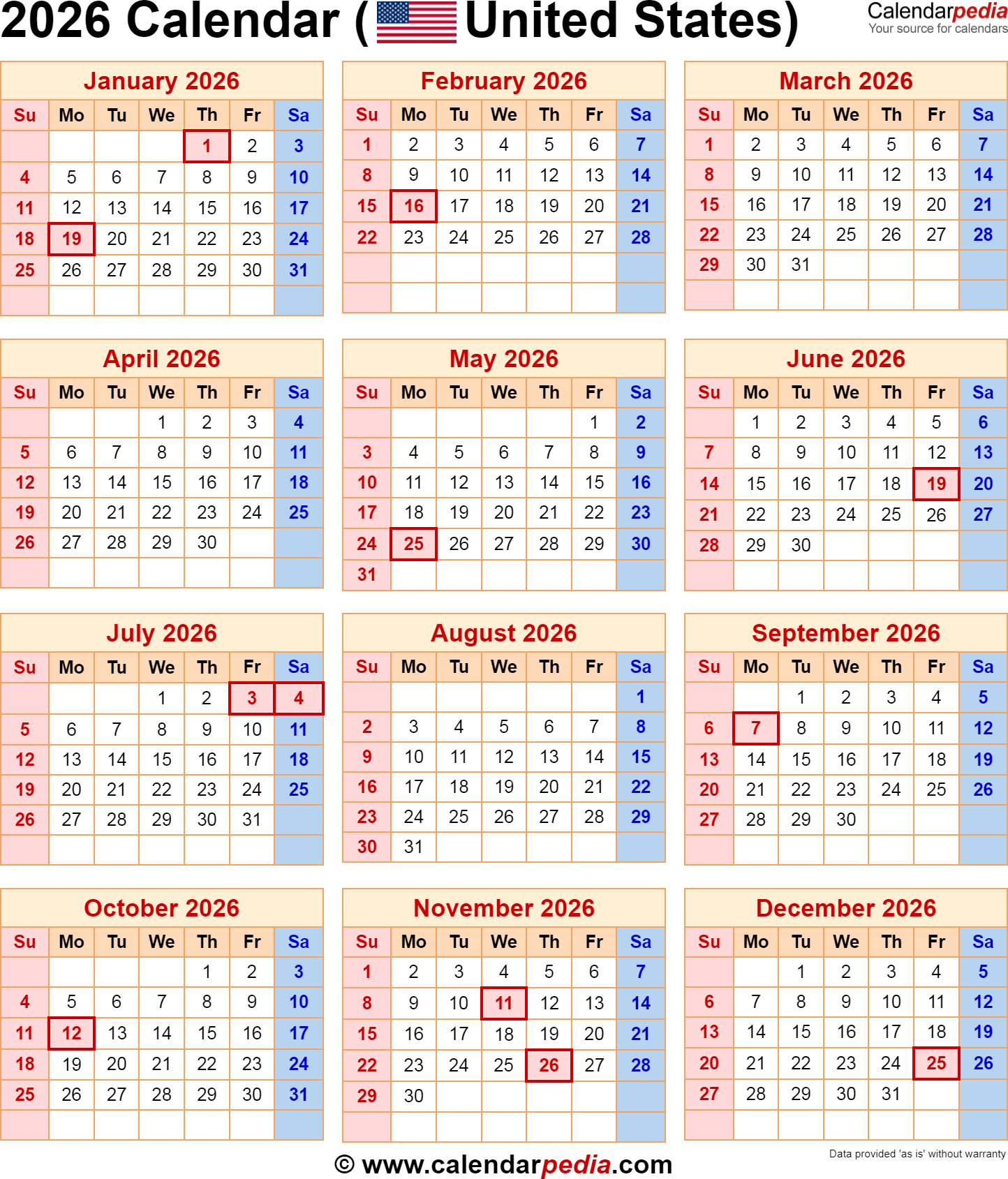

- Period 1: Four months (typically January to April)

- Period 2: Four months (typically May to August)

- Period 3: Five months (typically September to January)

This structure, with its uneven distribution of months, offers a departure from the conventional calendar, potentially impacting financial reporting, budgeting, and operational planning.

Advantages of the 4-4-5 Fiscal Calendar: A Closer Look

The 4-4-5 fiscal calendar presents several potential advantages, making it an attractive option for various organizations:

1. Aligning with Business Cycles: Many businesses experience natural peaks and troughs throughout the year. The 4-4-5 calendar allows for the flexibility to align reporting periods with these cycles, providing a more accurate reflection of financial performance. For instance, a retail company might experience a surge in sales during the holiday season, which can be better captured within the five-month period.

2. Enhanced Financial Reporting: The extended five-month period allows for a more comprehensive analysis of financial performance, encompassing key seasonal fluctuations. This enhanced data can lead to more informed decision-making, supporting strategic planning and resource allocation.

3. Improved Budgeting and Forecasting: The 4-4-5 structure can facilitate more accurate budgeting and forecasting. By aligning financial periods with business cycles, organizations can better anticipate revenue and expenditure patterns, leading to more effective financial management.

4. Streamlined Operations: The calendar can streamline operations by allowing for more efficient resource allocation and project management. For example, a company might choose to align major project launches with the beginning of a new fiscal period, ensuring adequate resources and planning.

5. Increased Flexibility: The 4-4-5 calendar offers greater flexibility in terms of accounting and reporting practices. Organizations can tailor their reporting cycles to suit their specific needs, potentially leading to improved efficiency and accuracy.

Implementing the 4-4-5 Fiscal Calendar: A Practical Approach

Implementing the 4-4-5 fiscal calendar requires careful planning and execution. Organizations should consider the following factors:

1. Communication and Training: Clear communication and training are essential for a smooth transition. All stakeholders, including employees, customers, and external partners, should be informed about the change and its implications.

2. System Integration: Existing accounting and reporting systems need to be adapted to accommodate the new calendar structure. This may involve software upgrades or modifications to ensure seamless data integration and reporting.

3. Financial Reporting Adjustments: Financial reporting practices will need to be adjusted to reflect the new calendar structure. This may include changes to accounting policies, reporting timelines, and financial statement presentations.

4. Internal Processes: Internal processes, such as budgeting, forecasting, and performance management, should be aligned with the new calendar to ensure consistency and efficiency.

FAQs: Addressing Common Concerns

1. What are the potential drawbacks of the 4-4-5 fiscal calendar?

While the 4-4-5 calendar offers several advantages, it also presents potential drawbacks. These include:

- Complexity: The uneven distribution of months can introduce complexity into financial planning and reporting, requiring careful adaptation of existing processes and systems.

- Disruption: Switching to a new calendar structure can disrupt established workflows and routines, requiring a period of adjustment for all stakeholders.

- Comparability: Comparing financial data across different periods might become challenging due to the uneven lengths of the fiscal periods.

2. How does the 4-4-5 fiscal calendar impact tax reporting?

Tax reporting deadlines and requirements will remain aligned with the Gregorian calendar, regardless of the fiscal calendar adopted by an organization. However, the 4-4-5 structure might influence internal tax planning and reporting processes.

3. Can the 4-4-5 fiscal calendar be used by all types of organizations?

The suitability of the 4-4-5 fiscal calendar depends on the specific needs and characteristics of an organization. It may be particularly beneficial for businesses with cyclical revenue streams or those seeking to align their financial reporting with their operational cycles.

Tips for Successful Implementation:

1. Conduct a thorough feasibility analysis: Before implementing the 4-4-5 fiscal calendar, organizations should conduct a comprehensive feasibility study to assess its suitability for their specific needs and context.

2. Involve key stakeholders: Engaging key stakeholders, including employees, managers, and external partners, in the decision-making process can ensure buy-in and facilitate a smooth transition.

3. Provide adequate training: Comprehensive training programs should be developed to educate employees about the new calendar structure and its implications for their roles and responsibilities.

4. Implement phased rollout: A phased rollout approach can help minimize disruption and allow for gradual adjustments to existing processes and systems.

5. Monitor and evaluate: Regular monitoring and evaluation of the new calendar structure are crucial to identify any potential challenges and ensure its effectiveness.

Conclusion: A Promising Future for Financial Management

The 4-4-5 fiscal calendar presents a unique approach to financial planning and reporting, offering potential benefits for businesses and organizations. By aligning financial periods with business cycles, this calendar structure can enhance financial reporting, improve budgeting and forecasting, and streamline operations. While implementation requires careful planning and execution, the 4-4-5 fiscal calendar has the potential to optimize financial management and drive organizational success. As organizations continue to explore innovative approaches to financial management, the 4-4-5 fiscal calendar could become an increasingly popular option in the years to come, particularly for 2026 and beyond.

Closure

Thus, we hope this article has provided valuable insights into Understanding the 4-4-5 Fiscal Calendar: A Comprehensive Guide for 2026. We hope you find this article informative and beneficial. See you in our next article!