Navigating the Virginia Payroll Calendar for 2026: A Comprehensive Guide

Related Articles: Navigating the Virginia Payroll Calendar for 2026: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Virginia Payroll Calendar for 2026: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Virginia Payroll Calendar for 2026: A Comprehensive Guide

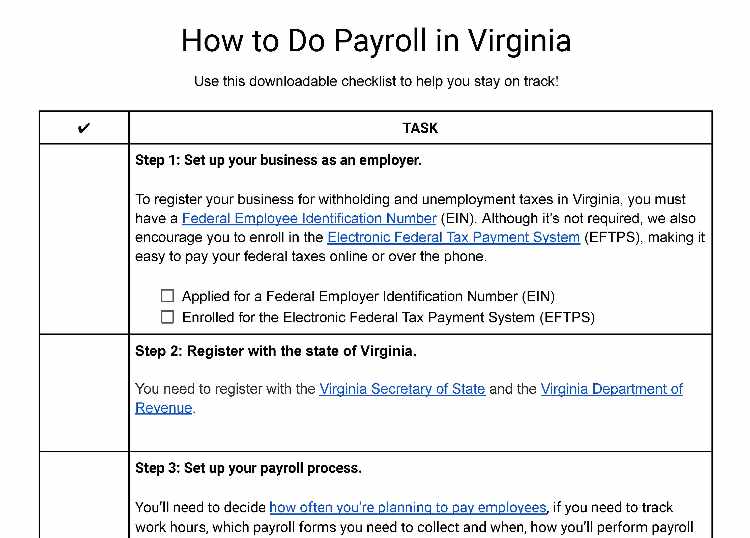

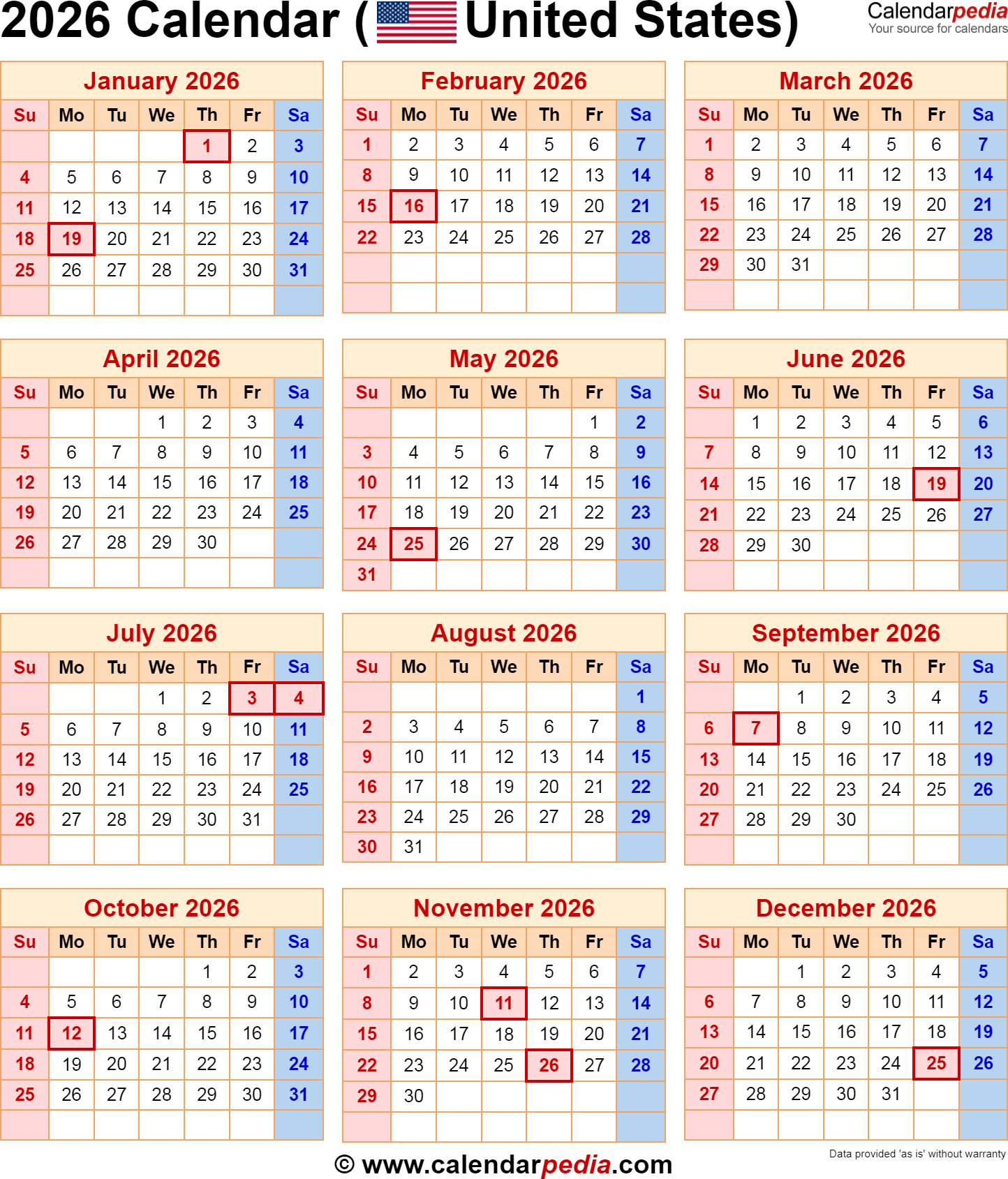

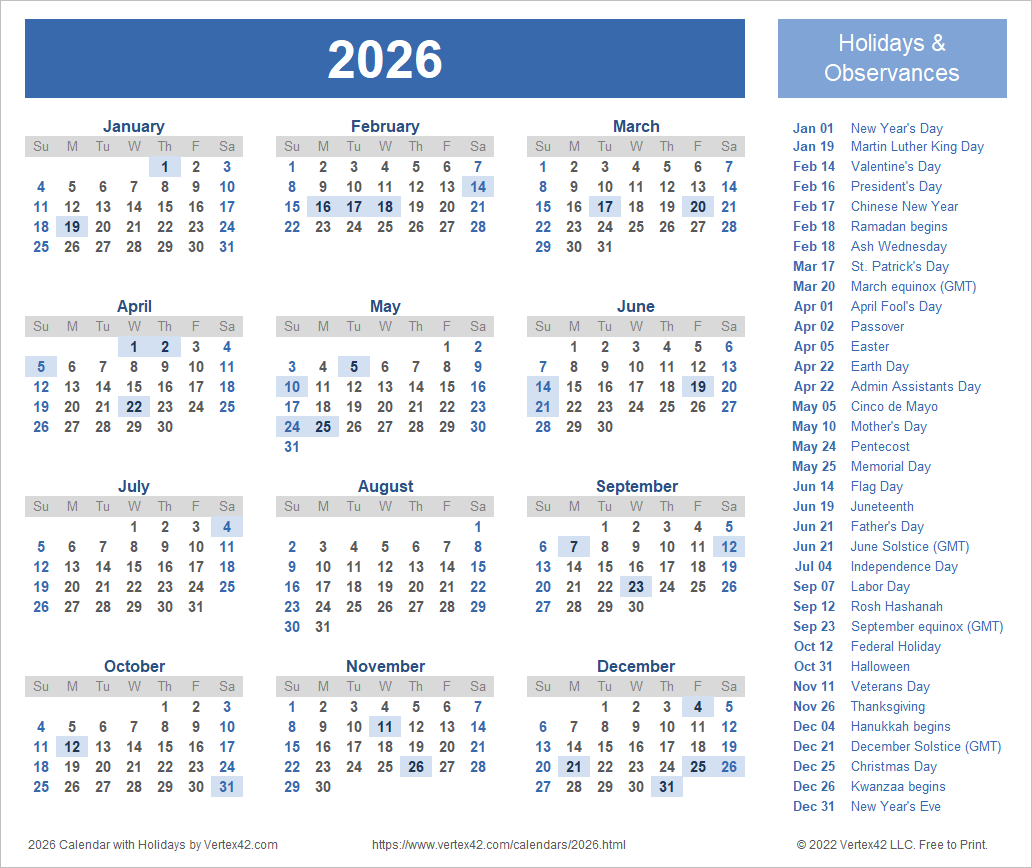

The Virginia Payroll Calendar for 2026 is a crucial tool for businesses operating within the state. It outlines the specific dates when payroll taxes and other relevant payments must be submitted to the Virginia Department of Taxation. Understanding this calendar is essential for ensuring timely and accurate compliance, avoiding potential penalties, and maintaining smooth financial operations.

Understanding the Calendar’s Significance

The Virginia Payroll Calendar serves as a definitive guide for employers, outlining the deadlines for various payroll-related obligations. These obligations include:

- Withholding Taxes: This encompasses federal, state, and local income taxes deducted from employee wages.

- Payroll Taxes: These include Social Security, Medicare, and unemployment taxes, which are shared between employers and employees.

- Other State Taxes: Depending on the nature of the business, additional taxes may apply, such as the Virginia Business, Professional, and Occupational License Tax (BPOL).

Failure to adhere to the designated deadlines can lead to penalties and interest charges, impacting the financial health of the business.

Key Features and Components

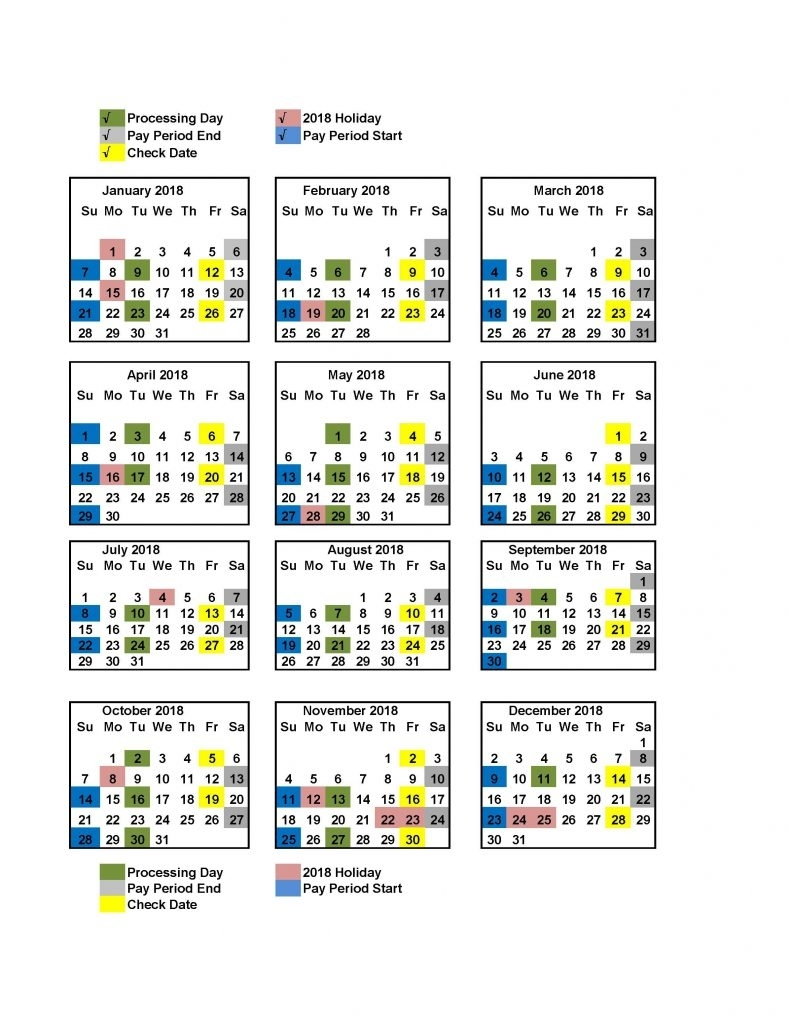

The Virginia Payroll Calendar typically includes:

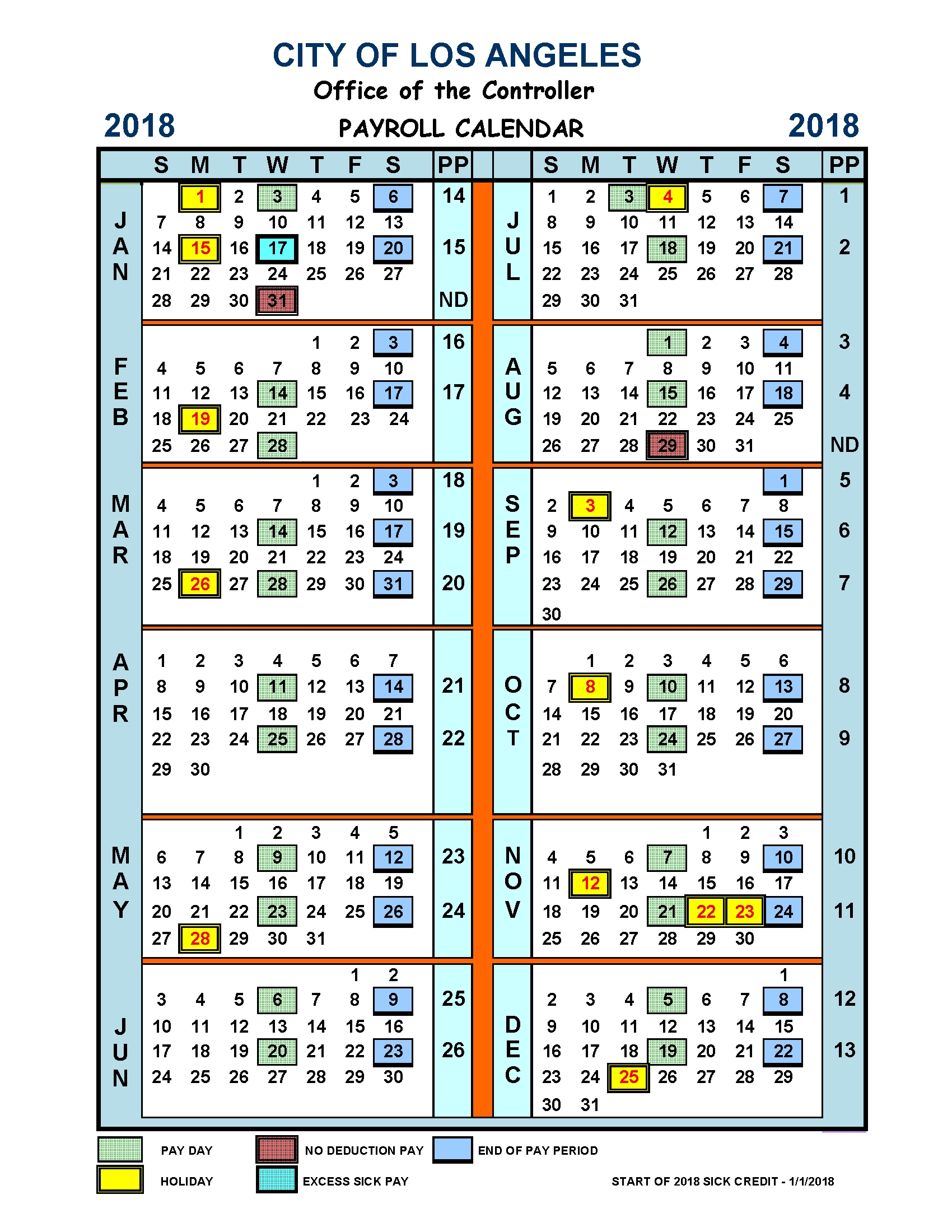

- Pay Periods: The calendar outlines the specific pay periods for the year, often categorized as bi-weekly, semi-monthly, or monthly.

- Payroll Tax Filing Deadlines: These dates indicate when payroll tax payments, including withholding taxes, must be submitted to the Virginia Department of Taxation.

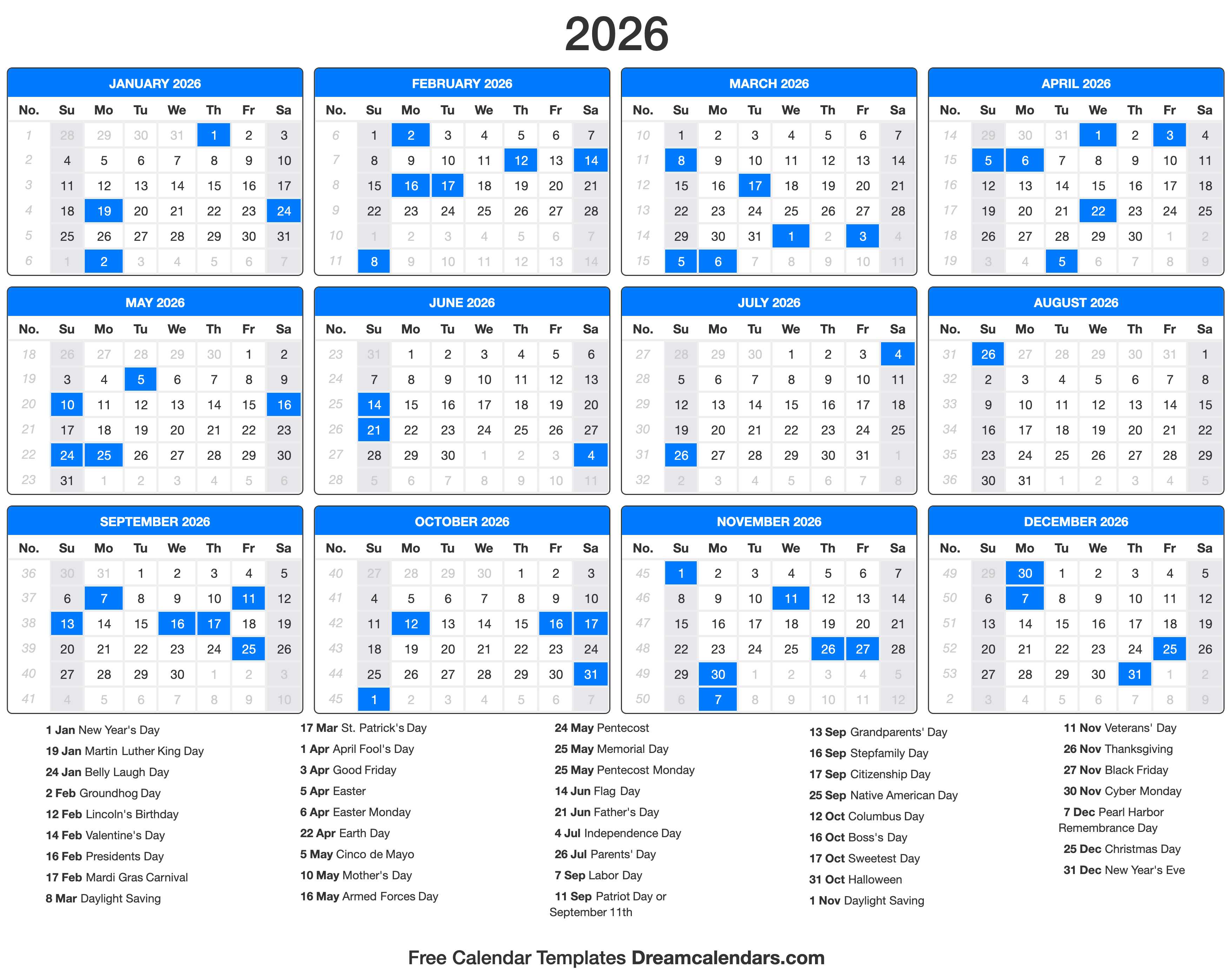

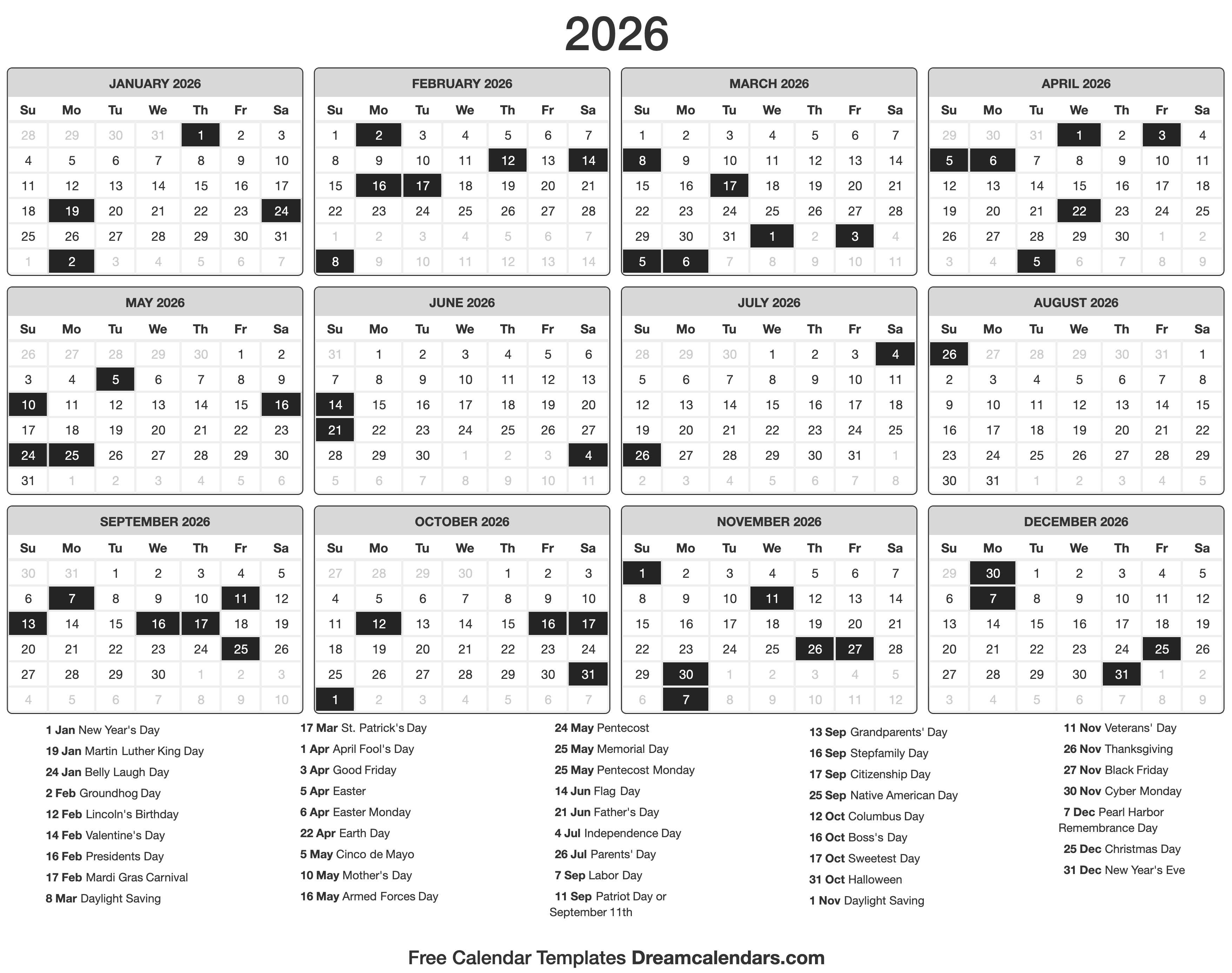

- State Holiday Observances: The calendar incorporates state holidays, which can affect payroll processing and payment schedules.

- Tax Filing Deadlines: For businesses operating under specific tax regulations, the calendar may also include deadlines for filing various tax returns.

Accessing the Calendar

The Virginia Payroll Calendar is typically available on the official website of the Virginia Department of Taxation. It can be accessed through the "Tax Information" or "Payroll" sections, often in a downloadable format, usually as a PDF or Excel spreadsheet.

2026 Calendar: A Hypothetical Example

While the exact dates for 2026 are not yet available, a hypothetical example based on previous years can illustrate the structure:

| Pay Period | Payroll Tax Filing Deadline | Notes |

|---|---|---|

| January 1-15 | January 22 | Bi-weekly pay period |

| January 16-31 | February 5 | Bi-weekly pay period |

| February 1-15 | February 19 | Bi-weekly pay period |

| … | … | … |

| December 16-31 | January 7, 2027 | Bi-weekly pay period |

Important Considerations for 2026

While the specifics of the 2026 calendar are yet to be released, some key considerations remain consistent:

- Tax Rate Changes: It’s crucial to stay updated on any potential changes in tax rates for 2026. The Virginia Department of Taxation may announce adjustments to income tax brackets or payroll tax rates.

- New Regulations: New state or federal regulations impacting payroll could be introduced, requiring businesses to adapt their processes and compliance strategies.

- Economic Fluctuations: Economic conditions can affect payroll obligations. For example, changes in unemployment rates may influence unemployment tax rates.

Engaging with the Calendar Effectively

- Regularly Update: It’s crucial to revisit the calendar frequently, especially around the beginning of each year, to ensure you have the most current information.

- Maintain a Record: Keep a physical or digital copy of the calendar readily accessible for reference throughout the year.

- Utilize Payroll Software: Employing payroll software can streamline the process of tracking payroll deadlines and managing associated tax payments.

FAQs

1. What are the penalties for late payroll tax payments?

Penalties for late payroll tax payments in Virginia can include interest charges, late filing penalties, and potential legal action. The specific penalties vary depending on the severity of the violation and the amount owed.

2. How often do I need to submit payroll tax payments?

The frequency of payroll tax payments typically aligns with the pay periods. For example, if a business pays employees bi-weekly, payroll tax payments are generally due bi-weekly as well.

3. Can I file my payroll taxes online?

Yes, the Virginia Department of Taxation offers online filing options for payroll taxes through its website. This allows for convenient and secure submission of tax payments.

4. What if I am a new business?

New businesses in Virginia need to register with the Department of Taxation and obtain a tax identification number (TIN) to comply with payroll tax requirements.

5. Where can I find additional information about payroll taxes in Virginia?

The Virginia Department of Taxation website provides a comprehensive resource for information about payroll taxes, including FAQs, guides, and forms. You can also contact the department directly for assistance.

Tips for Effective Payroll Management in 2026

- Proactive Approach: Develop a proactive approach to payroll management by staying informed about upcoming deadlines and tax changes.

- Automate Processes: Utilize payroll software or services to automate tasks such as calculating payroll, withholding taxes, and generating tax reports.

- Seek Professional Guidance: Consider consulting with a payroll specialist or accountant to ensure compliance with all applicable laws and regulations.

- Establish Internal Controls: Implement internal controls to minimize the risk of errors or fraud related to payroll processing.

- Stay Updated: Regularly review and update your payroll procedures to reflect any changes in regulations or best practices.

Conclusion

The Virginia Payroll Calendar for 2026 serves as a critical tool for ensuring accurate and timely compliance with payroll tax obligations. Understanding the calendar’s features, deadlines, and potential changes is crucial for businesses operating within the state. By adopting a proactive approach, utilizing available resources, and seeking professional guidance when needed, businesses can navigate the complexities of payroll management and maintain financial stability.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Virginia Payroll Calendar for 2026: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!