Navigating the Fiscal Year 2026 Calendar: A Comprehensive Guide

Related Articles: Navigating the Fiscal Year 2026 Calendar: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Fiscal Year 2026 Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Year 2026 Calendar: A Comprehensive Guide

The fiscal year, a distinct period for accounting and budgeting purposes, plays a crucial role in the economic and financial operations of governments, businesses, and organizations worldwide. Understanding the structure and nuances of a fiscal year is essential for informed decision-making, effective planning, and successful execution of financial strategies. This comprehensive guide delves into the intricacies of the fiscal year 2026 calendar, providing a clear and detailed understanding of its structure, significance, and practical implications.

The Foundation of Fiscal Years

Fiscal years are not aligned with the conventional calendar year (January to December). Instead, they represent a specific 12-month period that governments, businesses, and organizations choose for their financial reporting and budgeting cycles. This approach offers several advantages:

- Alignment with Business Cycles: Fiscal years can be tailored to coincide with peak seasons or significant business activities, facilitating accurate financial reporting and efficient resource allocation.

- Improved Budgetary Control: By establishing a distinct fiscal year, organizations can better manage their finances, track expenditures, and ensure that funds are utilized effectively within a defined timeframe.

- Simplified Reporting and Analysis: A dedicated fiscal year provides a structured framework for financial reporting, making it easier to compare data across different periods and analyze trends over time.

The Structure of the Fiscal Year 2026 Calendar

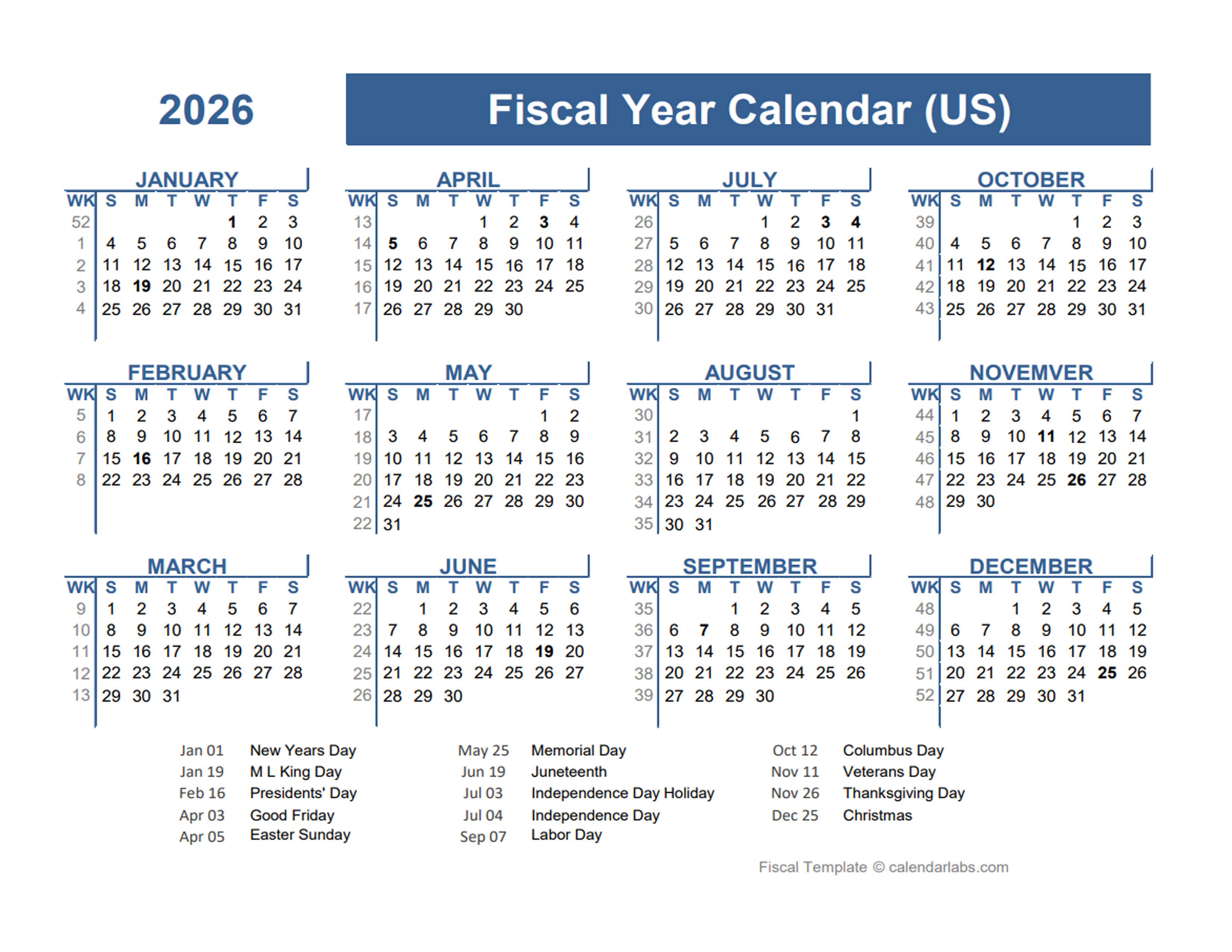

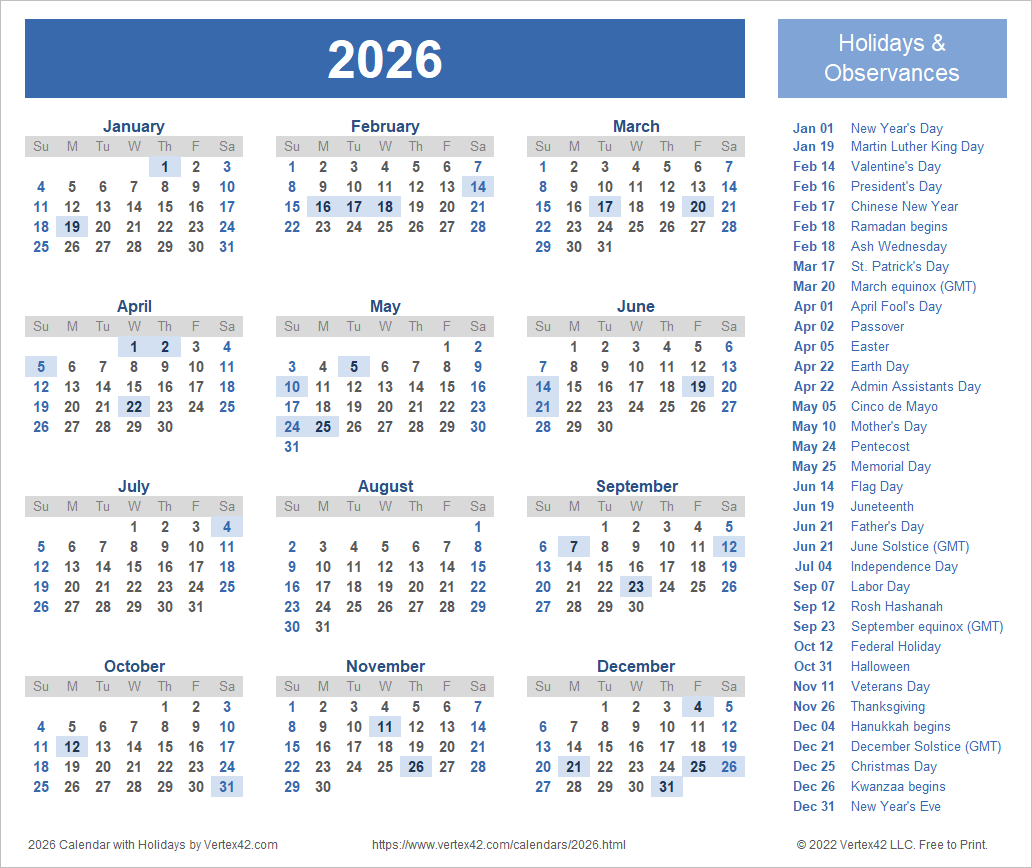

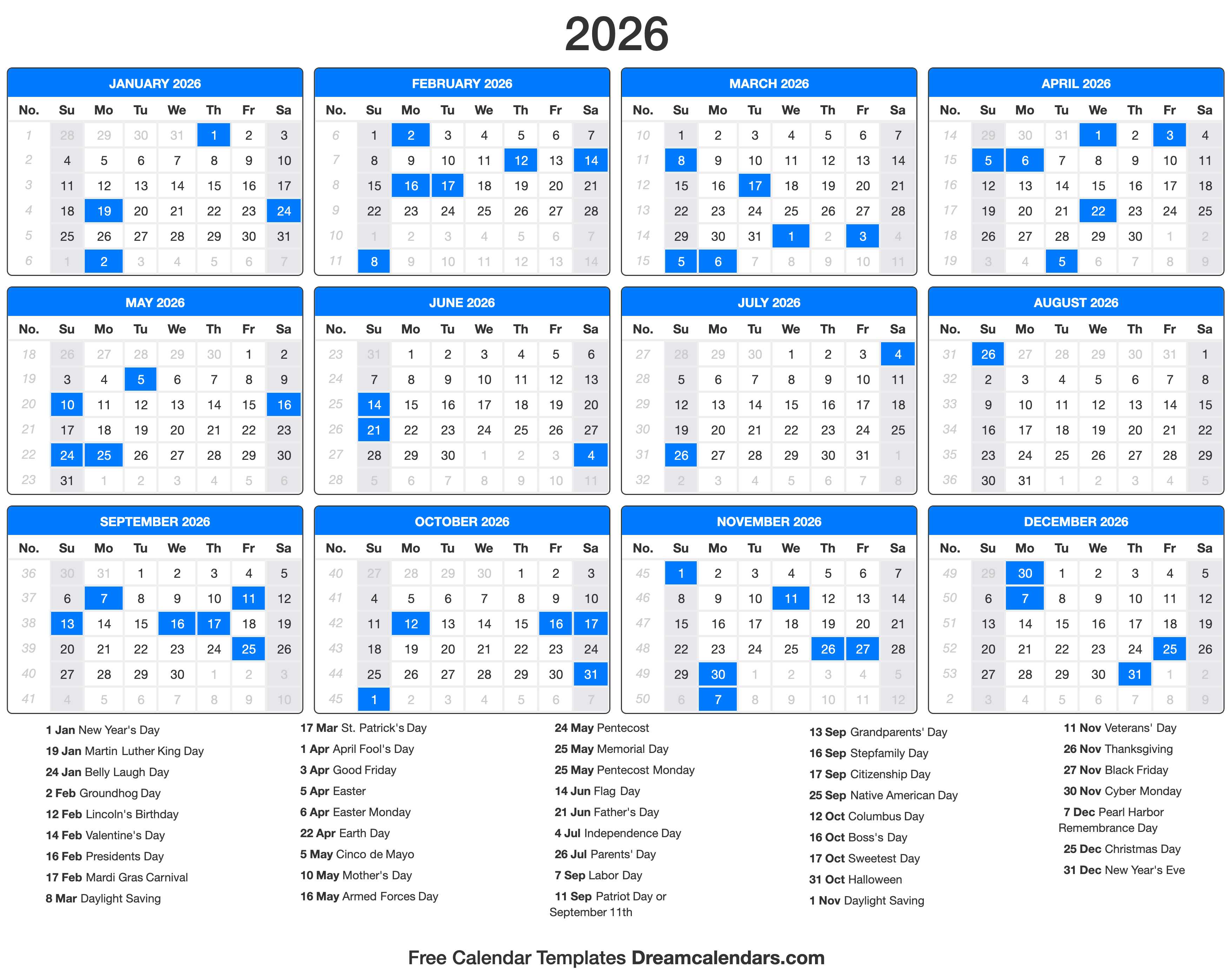

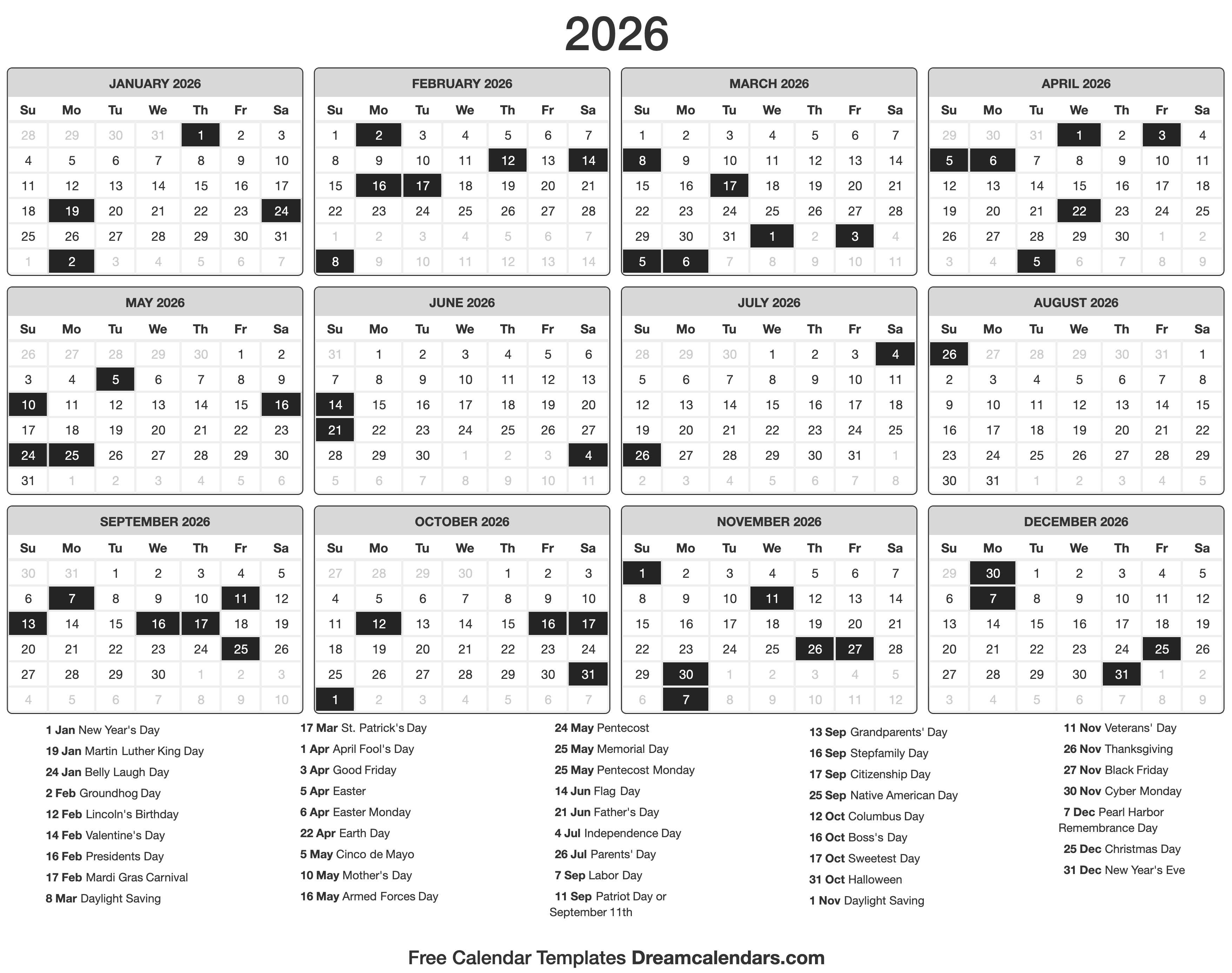

The fiscal year 2026 calendar, like all fiscal years, comprises 12 months. However, the starting and ending months vary depending on the specific fiscal year convention adopted by a particular entity. For example:

- United States Federal Government: The U.S. government operates on a fiscal year that begins on October 1st and ends on September 30th of the following year. Therefore, fiscal year 2026 will encompass the period from October 1, 2025, to September 30, 2026.

- Other Countries and Organizations: Many other countries and organizations have adopted different fiscal year conventions, with some aligning their fiscal year with the calendar year, while others utilize different starting and ending months.

The Importance of Fiscal Year 2026 Calendar

The fiscal year 2026 calendar holds significant importance for various stakeholders:

- Governments: Fiscal years are crucial for governments to plan and execute their budgets, allocate resources, and manage public finances. The fiscal year 2026 calendar will guide government spending, revenue collection, and policy decisions, impacting various sectors like education, healthcare, infrastructure, and defense.

- Businesses: Companies utilize fiscal years to track their financial performance, manage cash flow, prepare financial statements, and make strategic decisions. The fiscal year 2026 calendar will influence business planning, investment strategies, and overall financial health.

- Investors and Financial Institutions: Understanding the fiscal year cycle is essential for investors and financial institutions to analyze financial data, assess company performance, and make informed investment decisions. The fiscal year 2026 calendar will provide a framework for analyzing financial reports, evaluating market trends, and guiding investment strategies.

Practical Implications of the Fiscal Year 2026 Calendar

The fiscal year 2026 calendar has practical implications for various activities:

- Budgeting and Financial Planning: Organizations need to align their budgeting and financial planning cycles with the fiscal year 2026 calendar to ensure efficient resource allocation, accurate financial reporting, and effective financial management.

- Tax Filings and Reporting: Tax deadlines and reporting requirements are often linked to the fiscal year. Understanding the fiscal year 2026 calendar is crucial for individuals and businesses to meet their tax obligations and avoid penalties.

- Performance Measurement and Evaluation: Fiscal years provide a standardized period for measuring and evaluating performance across different organizations. The fiscal year 2026 calendar will be used to assess progress, identify areas for improvement, and set goals for future periods.

FAQs Regarding the Fiscal Year 2026 Calendar

Q1: How does the fiscal year 2026 calendar impact individual taxpayers?

A1: The fiscal year 2026 calendar will determine the tax year for individuals. Taxpayers will need to file their income tax returns for the income earned within the fiscal year 2026, which may differ from the calendar year depending on the specific fiscal year convention adopted by their country or jurisdiction.

Q2: What are the key dates to remember for the fiscal year 2026 calendar?

A2: Key dates to remember for the fiscal year 2026 calendar include:

- Start Date: The specific start date will depend on the fiscal year convention used. For the U.S. federal government, it’s October 1, 2025.

- End Date: The specific end date will depend on the fiscal year convention used. For the U.S. federal government, it’s September 30, 2026.

- Tax Filing Deadline: The tax filing deadline for the fiscal year 2026 will vary depending on the country or jurisdiction.

Q3: How can businesses prepare for the fiscal year 2026 calendar?

A3: Businesses should:

- Align Budgeting and Financial Planning: Ensure that their budgeting and financial planning processes align with the fiscal year 2026 calendar.

- Review and Update Financial Strategies: Conduct a thorough review of their financial strategies and make necessary adjustments to accommodate the fiscal year 2026 calendar.

- Monitor Key Performance Indicators: Track key performance indicators (KPIs) to evaluate progress and make informed decisions throughout the fiscal year.

Tips for Effectively Utilizing the Fiscal Year 2026 Calendar

- Plan Ahead: Develop comprehensive financial plans that align with the fiscal year 2026 calendar, considering all relevant factors such as revenue projections, expenses, and capital investments.

- Track Progress Regularly: Monitor financial performance throughout the fiscal year 2026, comparing actual results against planned targets and identifying areas for improvement.

- Communicate Effectively: Ensure clear and timely communication with stakeholders regarding financial performance, budget updates, and any significant changes.

- Stay Informed: Keep abreast of any changes or updates to fiscal year conventions, tax regulations, and other relevant factors that may impact financial planning and operations.

Conclusion

The fiscal year 2026 calendar serves as a crucial framework for financial planning, budgeting, and reporting for governments, businesses, and individuals. Understanding its structure, significance, and practical implications is essential for informed decision-making, effective resource allocation, and successful financial management. By aligning activities with the fiscal year 2026 calendar, organizations can optimize their financial performance, meet their financial obligations, and achieve their strategic goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Year 2026 Calendar: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!